Why Hospitality

Global travel has changed forever. Since the pandemic, travelers have shifted away from generic chain hotels, seeking intimate, design-driven stays that feel authentic. At the same time, lifestyle-driven retail, such as food & beverage, wellness, and essential services, continues to thrive, creating a unique opportunity for investors who want both growth and stability.

At Double Diamond Capital Investments, we focus on boutique hospitality and lifestyle real estate because these markets deliver what today’s travelers and tenants demand: authenticity, cultural connection, and long-term consistency.

Why Boutique Hospitality

Rising Demand – International tourism has surpassed pre-pandemic levels, fueling record bookings at boutique hotels and villas.

Premium Returns – Boutique assets command higher ADRs (Average Daily Rates) due to design, exclusivity, and curated guest experiences.

Value Creation – Through luxury renovations, brand partnerships, and added experiences (wellness, dining, events), we unlock appreciation beyond room revenue.

Why Net Lease Retail

Stability – Tenants include investment-grade brands in food, wellness, and lifestyle sectors.

Predictable Income – Long-term corporate leases with built-in rent escalations deliver bond-like cash flow.

Inflation Hedge – Structured leases allow income to rise with inflation while preserving tenant quality.

Why These Markets

We invest where tourism and lifestyle demand are accelerating, infrastructure is expanding, and governments welcome foreign investment. Our current focus includes:

Mexico’s Riviera Maya – 23% YoY tourism growth and record foreign direct investment.

Belize (Ambergris Caye & Mahogany Bay) – 115% recovery vs. pre-pandemic, unrestricted foreign ownership.

Porto, Portugal – 74% occupancy with €550M hotel investment volume in 2024.

Tuscany, Italy – Luxury hotel growth of 24%, global brand recognition, and historic villa conversion opportunities.

The Investor Advantage

This dual-asset approach blends the upside of hospitality with the stability of retail, producing:

Strong equity appreciation

Predictable cash flow

Diversification across geographies and asset classes

Flexible exit strategies including portfolio sales, 1031 buyers, or REIT conversion.

Apartments outperform stocks and bonds

Investing in apartments is wise for those who want to avoid high-risk investments. Not only can multifamily investments bring tremendous equity growth, but they can provide monthly income more significant than what you would get from stocks and bonds, making it an even better choice if your goal is maximizing return on investment while minimizing the risk of your portfolio.

Multifamily investments outperform other real estate classes

Apartments have been the best investment amongst all other real estate classes. Because of the nature of multifamily properties and how we structure our investment properties, we can make significant cash flow plus equity growth which yields higher overall returns than all other real estate asset classes.

Take Advantage of Increased Tax Benefits

Our team strategically acquires luxury boutique hotels, villas, and net lease retail assets with strong cash flow and appreciation potential. This allows investors to enjoy healthy returns while still benefiting from significant tax-advantaged structures each year.

We leverage three powerful forms of depreciation that pass directly through to our investors:

Standard or Straight-line Depreciation

Accelerated Depreciation

Bonus Depreciation

Every hospitality and retail acquisition undergoes a cost segregation study, maximizing depreciation schedules and shielding income from taxes. These benefits flow through to investors via annual K-1 reporting, providing year-end clarity and efficiency.

Demand for boutique hospitality is at an all-time high and accelerating.

Since the pandemic, global travelers have shifted away from generic chain hotels, choosing intimate, design-driven stays that feel authentic. At the same time, lifestyle-driven retail such as food & beverage, wellness, and essential services continues to thrive, providing long-term stability. Millennials seek unique travel experiences, while baby boomers increasingly invest in luxury escapes and wellness retreats—fueling sustained demand across both hospitality and retail assets.

Occupancy rates in luxury hospitality and net lease retail remain strong due to global demand shifts.

International travel has surpassed pre-pandemic levels, fueling record bookings at boutique hotels and villas, while net lease retail enjoys near-zero vacancy thanks to investment-grade tenants with long-term commitments. This combination delivers stable monthly cash flow and long-term equity growth, translating into higher overall returns for our investors.

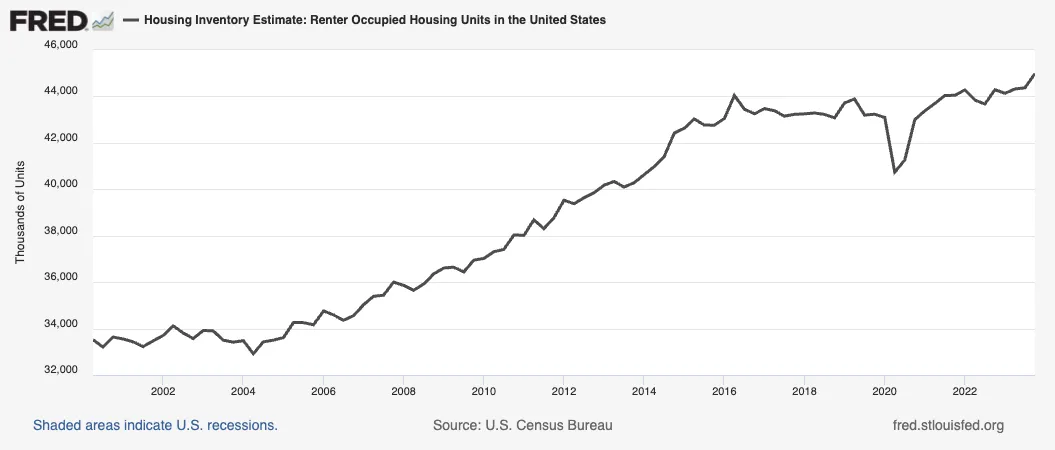

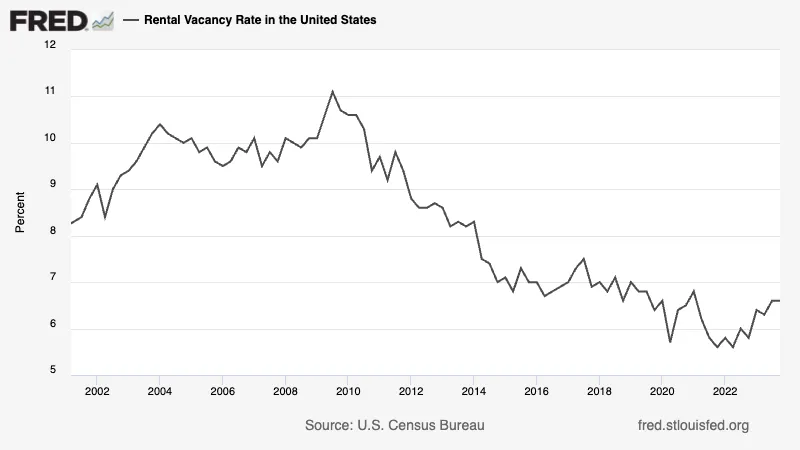

Demand for apartments is at an all-time high and still climbing

Since its peak in the mid-2000s, home ownership has been significantly dropping, and it will continue to drop as millennials, and aging baby boomers want to stay mobile in the 21st century.

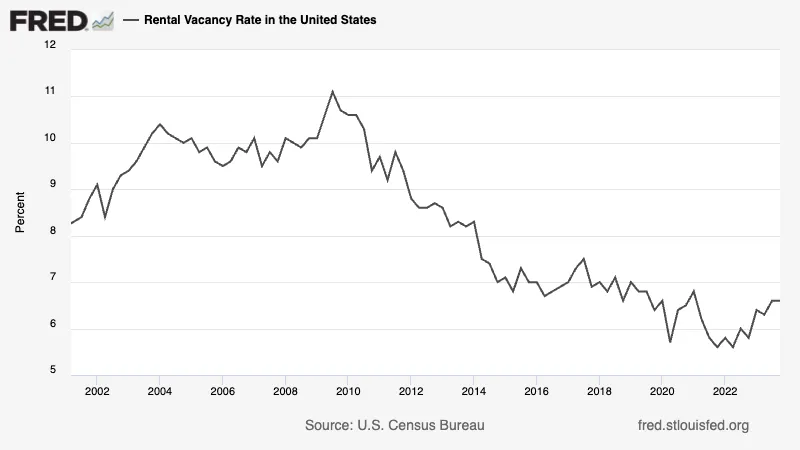

Vacancy rates remain low due to increased demand

With the population continuing to increase, demand for apartments is at an all-time high. This increase drives the need for apartment living higher and higher. Low vacancy rates equal more significant cashflow and equity growth, which translates to higher returns for our investors.

See for yourself why investors love working with us!

INFORMATION LINKS