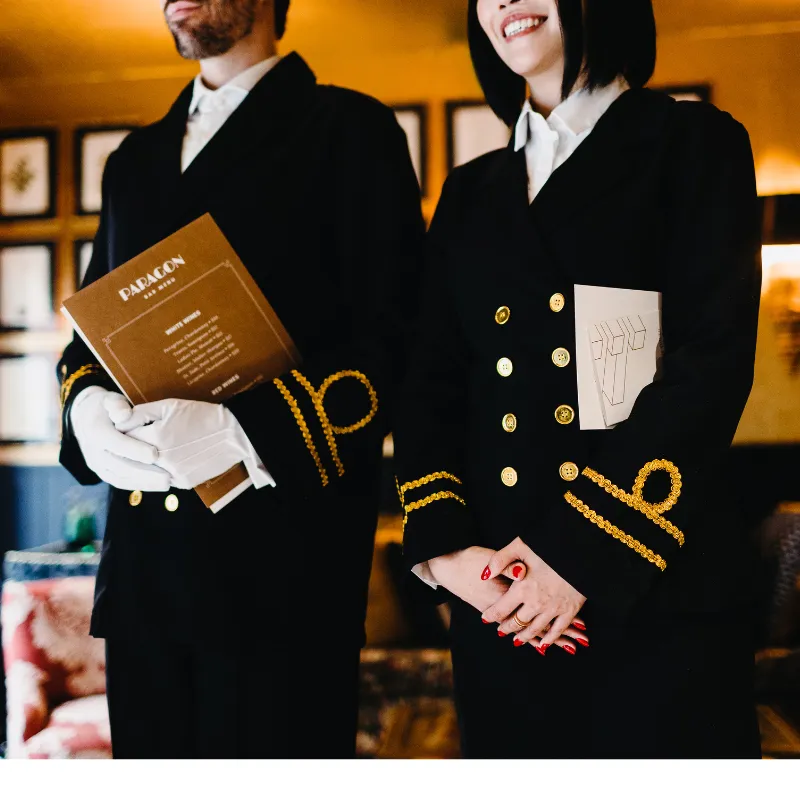

Earn Passive Income Investing in Boutique Hospitality & Lifestyle Real Estate

We acquire and reposition boutique hotels, luxury villas, and net lease lifestyle retail. Our dual-engine strategy combines high-growth hospitality with the stability of long-term corporate leases.

Earn Passive Income Investing In Multifamily Properties

We maximize investor returns by increasing net operating income throughout the holding period through a hands-on management style of heavy renovation and aggressive lease-up.

What We Do

Add Boutique Hospitality & Lifestyle Real Estate to Your Portfolio

We are hospitality and retail investment experts with hands-on experience in acquisitions, development, and asset management. Our network provides exclusive access to off-market boutique hotels, villas, and retail assets in premier global destinations. With strong partnerships and local expertise, we deliver institutional-grade opportunities to individual investors.

INVESTMENT TYPE

Let us help you grow your wealth through passive investments in luxury boutique hotels, private villas, and net lease lifestyle retail properties. Our dual-asset approach blends the growth potential of hospitality with the stability of long-term retail leases.

TARGET RETURNS

Each investment opportunity has its own financial profile, but we target a 12.5–15.2% internal rate of return (IRR) over a 5-year horizon, with 8–12% current yield generated by the net lease retail allocation during hotel development and stabilization.

TIME FRAME

We typically hold investments between 5 to 7 years, depending on market conditions, hospitality ramp-up, and exit opportunities. Multiple exit strategies—including individual asset sales, portfolio transactions, and REIT conversion—help protect investor capital while optimizing returns.

Why Invest With Us

We are part of a strong investor network with over $309 million in collective assets and thousands of units managed across the U.S. Through our strategic partnerships, we bring deep expertise in leasing, hospitality development, and capital structuring. This combined experience gives Double Diamond access to institutional-grade opportunities in boutique hospitality and net lease retail, creating both stability and growth for our investors.

Why You Should Add Real Estate to Your Investment Plan

CASHFLOW

Quarterly distributions after expenses.

STABILITY

Hospitality + retail outperform traditional real estate cycles.

TAX BENEFITS

Depreciation and cost segregation studies maximize tax efficiency.

LEVERAGE

Real estate allows investors to control large assets with smaller equity.

AMORTIZATION

Debt pay down creates long-term equity growth.

APPRECIATION

Strategic repositioning drives asset value upward.

See for yourself why investors love working with us!

INFORMATION LINKS